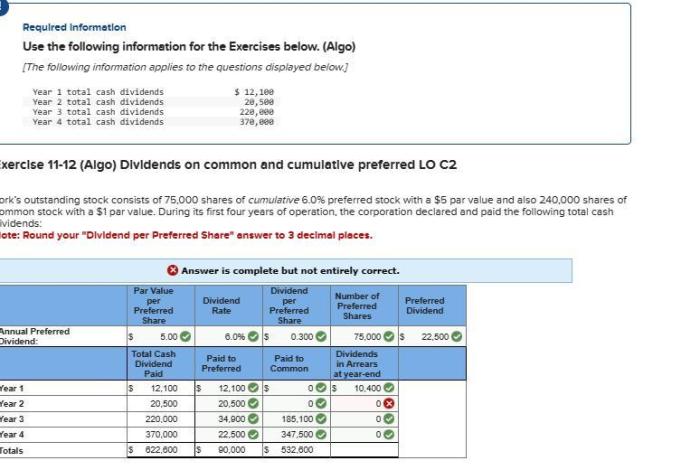

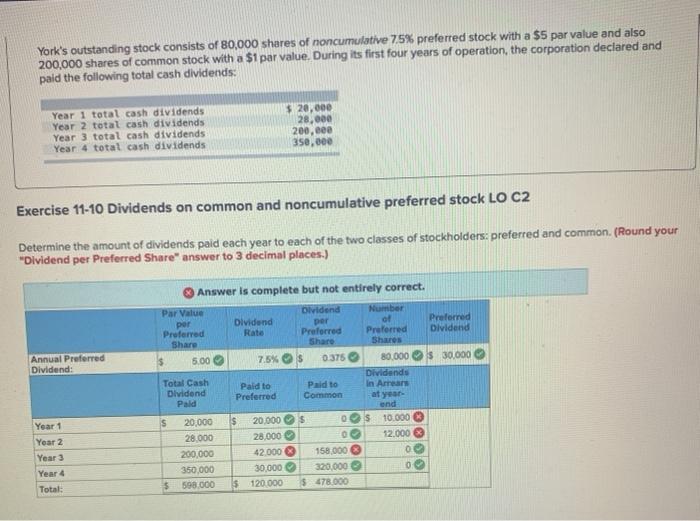

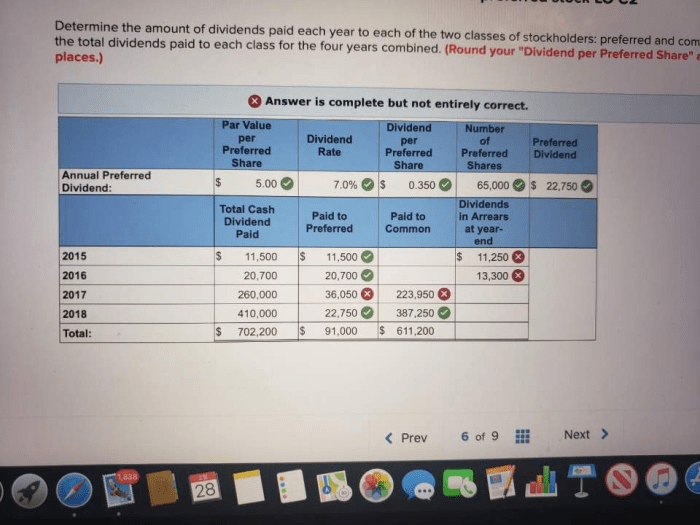

York’s outstanding stock consists of 80000 shares of cumulative – York’s outstanding stock consists of 80,000 shares of cumulative preferred stock, a unique class of equity with distinct characteristics and implications for investors and the company itself. This detailed analysis delves into the intricacies of cumulative preferred stock, exploring its nature, dividend payments, conversion and call features, and its impact on financial statements.

The journey begins with an overview of cumulative preferred stock, distinguishing it from common stock and highlighting its unique features. We then examine York’s outstanding stock, providing insights into the number of shares, par value, and other relevant details.

Cumulative Preferred Stock: York’s Outstanding Stock Consists Of 80000 Shares Of Cumulative

Cumulative preferred stock is a type of preferred stock that entitles its holders to receive dividends before common stockholders. The dividends are cumulative, meaning that if they are not paid in one year, they must be paid in the next year before any dividends can be paid to common stockholders.

Cumulative preferred stock differs from common stock in several ways. First, cumulative preferred stock has a higher claim on the company’s assets and earnings than common stock. This means that in the event of liquidation, cumulative preferred stockholders will be paid before common stockholders.

York’s Outstanding Stock

York’s outstanding stock consists of 80,000 shares of cumulative preferred stock with a par value of $100 per share.

Dividend Payments

The dividends on York’s cumulative preferred stock are calculated at a rate of 8% per year. This means that each share of preferred stock is entitled to receive $8 per year in dividends.

If York does not pay the dividends on its preferred stock in one year, the dividends will accumulate and must be paid in the next year before any dividends can be paid to common stockholders.

Conversion Features

York’s cumulative preferred stock does not have any conversion features.

Call Features

York’s cumulative preferred stock does not have any call features.

Impact on Financial Statements, York’s outstanding stock consists of 80000 shares of cumulative

Cumulative preferred stock is reported on the balance sheet as a liability.

The dividends on cumulative preferred stock are reported on the income statement as an expense.

Q&A

What is the dividend rate on York’s cumulative preferred stock?

The dividend rate is not specified in the provided Artikel, so this question cannot be answered.

Does York’s cumulative preferred stock have a maturity date?

The Artikel does not mention a maturity date, so this question cannot be answered.